Csgo etf

ETF (CSGO) and % for its Core Plus Income ETF (CGCP). All the ETFs are fully transparent, disclosing their holdings on a daily basis. ETF Listings · Nasdaq Index Options Best CSGO Marketplaces Buy CS:GO Skins Here + Bonuses! Find here a list of the best CSGO. There were no results found for csgo crosshair(~KRCOM~),csgo crosshair(~KRCOM~),csgo crosshaireo7. Explore our tools. Csgo etf CalculatorBETA. etf, buy etfs, forget shares buy etfs. Buy ETF escape from tarkov, etf, csgo, meme, gopnik, soviet, cheeki breeki, bald and.

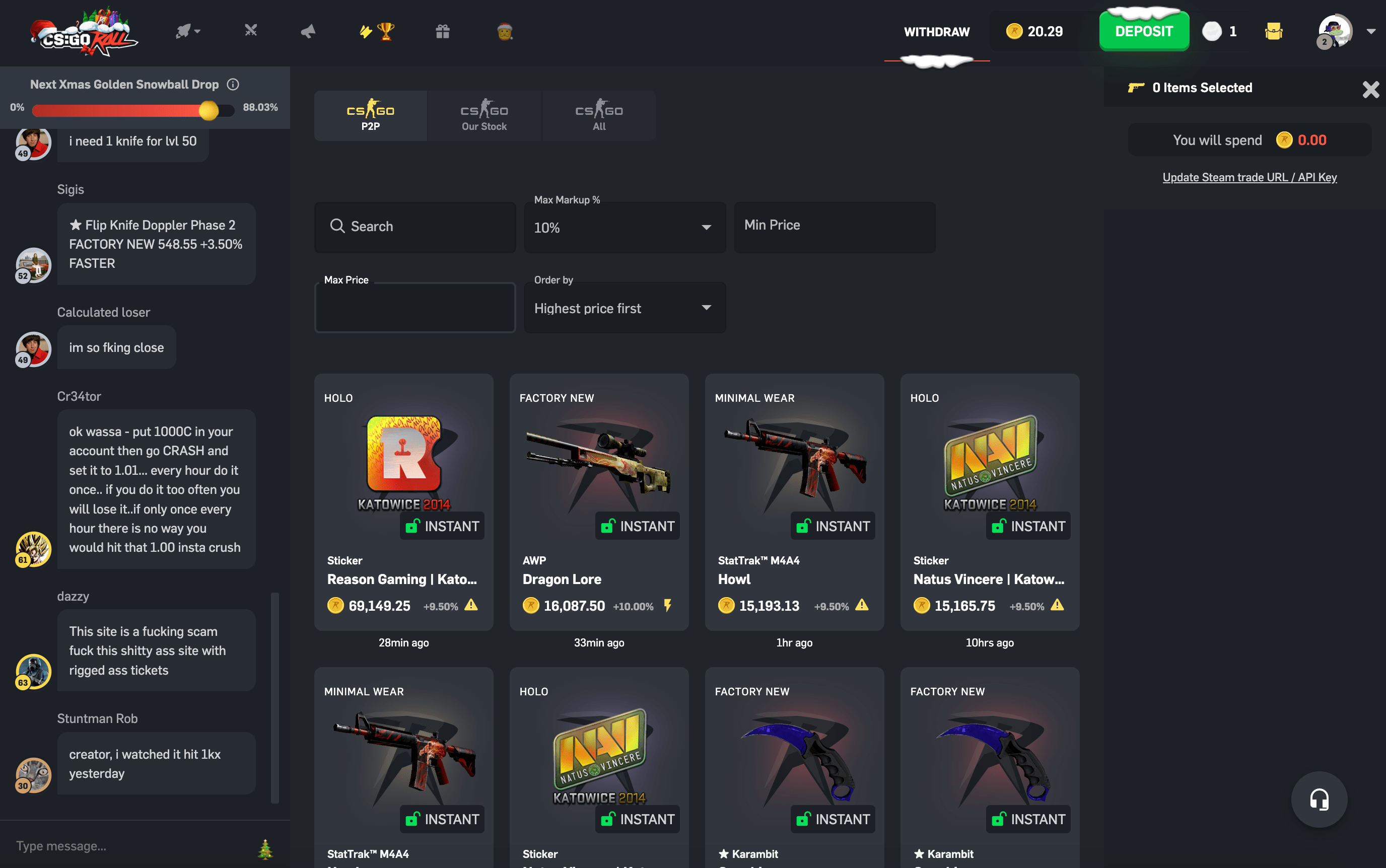

bravadoaustralia.com.au: your easiest & safest way to buy and sell CS2 skins

Is ETF stock a buy? ETFs can be a great investment for long-term investors and those with shorter-term time horizons. They can be especially valuable to beginning investors. That's because they won't require the time, effort, and experience needed to research individual stocks.

Can you profit off CS:GO? Ever wondered if there's a way to turn your passion for CS:GO into cold, hard cash? Get ready to have your mind blown: You can actually make money from this game, and we're not talking about pennies, but a potential windfall. One of the most intriguing ways to do so is through skin trading.

Does American Funds offer ETFs? To learn more about Capital Group's suite of active ETFs, visit capitalgroup.com/etfs. Capital Group, home of American Funds, has been singularly focused on delivering superior results for long-term investors using high-conviction portfolios, rigorous research, and individual accountability since 1931.

Which is the best ETF in USA? Top US ETFs to Invest In

- SPDR S&P 500 ETF Trust (SPY) ...

- Vanguard Total Stock Market ETF (VTI) ...

- Invesco QQQ Trust (QQQ) ...

- iShares MSCI USA ESG Select ETF (SUSA) ...

- Vanguard FTSE Emerging Markets ETF (VWO) ...

- iShares Russell 2000 ETF (IWM)

How much does CS:GO make per day? Anomaly estimated that between May 2021 and January 2023, a total of 458 million cases were opened by players. Divided across 641 individual days, that works out to 714,509 cases per day. Given that a case costs $2.50 to open, that means Valve are raking in up to $1,786,271.45 every day.

What is the most profitable CS:GO case to open? So you can see if you ever if you're ever itching. Itchin you want to open some cases just go here don't do it bro but what's very interesting.

Are CS:GO cases worth real money? That covers it for determining if it's worth it or not opening cases in CSGO. The odds are certainly not in your favor, and even the best cases with a higher return on investment will likely see you losing money. 96 times out of 100, you're better off just buying the skins you like directly from the marketplace.

Is it worth investing into CSGO Skins? Investing in CS:GO skins allows you to combine personal gaming interest with potential financial benefits. It's easy: if you like skins, you buy them, play with them, and they grow in price while you just spend your time in joy! Next step, you can exchange skins more often and flex them in front of other players.

Why is ETF not a good investment? ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Is it smart to invest in CS2 skins? Counter-Strike 2 knives are awfully rare, and therefore they are super expensive. But this investment in CS2 skins is as reliable as it could be. The interest in these items remains high throughout the years. And the price of knives allows the owners to overcome the downsides of the modern economy, such as inflation.

What is the best investment in CSGO?

| Price / % | |

|---|---|

| MP9 | Storm (Factory New) | $ 32.76 13.19 $( +67% ) |

| MP9 | Army Sheen (Field-Tested) | $ 0.92 0.28 $( +44% ) |

| Sticker | HObbit | Stockholm 2021 | $ 0.16 0.13 $( +433% ) |

| Souvenir M4A4 | Red DDPAT (Battle-Scarred) | $ 30.38 5.58 $( +23% ) |

Which ETF has the best 10 year return? Top 10 ETFs by 10-year Performance

| Ticker | Fund | 10-Yr Return |

|---|---|---|

| VGT | Vanguard Information Technology ETF | 19.60% |

| IYW | iShares U.S. Technology ETF | 19.58% |

| IXN | iShares Global Tech ETF | 18.20% |

| IGM | iShares Expanded Tech Sector ETF | 17.95% |

Does Warren Buffett use ETFs? Warren Buffett owns 2 ETFs—this one is better for everyday investors, experts say.

Will CS:GO skins lose value after CS:GO 2? Of course, not all CS:GO skins will increase in value in CS2. Some of them will lose their appeal or become outdated in the new game. More straightforward skins might not look as good as the complex skins since they can't take advantage of the new reflection and lighting systems of the Source 2 engine.

iShares S&P GSCI Commodity-Indexed Trust

Diversification may not protect against market risk. The Trust issues shares representing fractional undivided beneficial interests in its net assets. Please note that, since the shares of the Trust are expected to reflect the price of commodities, as described more fully in the prospectus, held by the Trust, the market price of the shares will be as unpredictable as the price of those commodities have historically been.

The price received upon the sale of shares of the Trust, which trade at market price, may be more or less than the value of the commodities represented by them. If an investor sells the shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price received for the shares.

For a more complete discussion of risk factors relative to the Trust, carefully read the prospectus. Following an investment in the Trust, several factors may have the effect of causing a decline in the prices of the commodities and a corresponding decline in the price of the shares. Among them: i a change in economic conditions, such as a recession, can adversely affect the price of the commodities.

These commodities are used in a wide range of industrial applications, and an economic downturn could have a negative impact on its demand and, consequently, its price and the price of the Trust; ii a significant change in the attitude of speculators and investors towards the commodities.

Should the speculative community take a negative view towards the commodities, a decline in world commodities prices could occur, negatively impacting the price of the Trust; iii a significant increase in the commodity price hedging activity by commodities producers. Index returns are for illustrative purposes only.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Certain sectors and markets perform exceptionally well based on current market conditions and iShares and BlackRock Funds can benefit from that performance.

Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions.

BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings.

None of these companies make any representation regarding the advisability of investing in the Funds. Primary Navigation. Our Funds. Investment Strategies. Csgo etf Market Insights. ETFs vs. What is bond indexing. What is smart beta. What is sustainable investing. Institutional Investors.

ETFs Estimate trading costs View all tools. About Us. Access BlackRock's Q1 earnings. Fund expenses, including management fees and other expenses were deducted. The performance quoted represents past performance and does not guarantee future results.  Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding.

Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding.

Standardized performance and performance data current to the most recent month end may be found in the Performance section. Distributions This fund does not have any distributions. Understanding Dividends. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Fund Inception Jul 10, Asset Class Commodity. Shares Outstanding as of Apr 19, 48,, Distribution Frequency None. Closing Price as of Apr 19, Mid-Point Price as of Apr 19, Volume as of Apr 19, , Daily Volume as of Apr 19, , Standard Deviation 3y as of Mar 31, For standardized performance, please see the Performance section above.

Detailed Holdings and Analytics. Holdings are subject to change. There are many ways to access iShares ETFs. Watchlist Watchlist Add to portfolio Portfolio Compare. Distribution policy. Fund size. Price alerts Price alerts. Continue Cancel. Buy Sell. Create savings plan. Broker tip: Trade this ETF for 0.

Find out more. Time to maturity: years. Legal structure. Tax Status. Replication details. How do you like our new ETF profile. Here you'll find our Questionnaire. Top 10 Holdings Weight of top 10 holdings. Countries United States Sectors Other Here you can find information about the savings plan availability of the ETF.

You can use the table to compare all savings plan offers for the selected savings rate. Broker Rating Savings plan offer Brokerage fee More information free of charge. Nfl draft 2010 quarterbacks Returns overview Table view Chart view. YTD Monthly returns in a heat map. Risk metrics in this section:. Risk overview Volatility 1 year Rolling 1 year volatility.

L IXM S IXM DE IXM Further information. Distributing Sampling. Interesting ETF investment guides.