Negative spread meaning

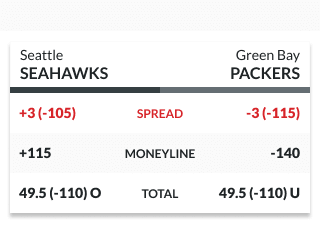

A plus sign (+) means that team is the underdog. Here's how DraftKings displays its point spreads for football, with the point spread boxed in. Negative spread refers to the negative difference between the interest rate paid by a bank and the agreed upon basic interest rate. A negative spread. negative” symbol (-). These are ubiquitous For example, with sports like the NBA or NFL, point spread wagers will typically have the standard point spread. A minus 3 spread in basketball means that the favored team is expected to win by 3 points. For negative spread meaning, if the Golden Stare Warriors were -3 against the Boston.

Find a legal form in minutes

Why would you bet on a negative spread? In the simplest terms, a negative spread indicates the favorite, which is the side expected to win the matchup. A negative point spread really means the team has some work to do. For a negative spread bet to hit, the team has to beat its opponent by a margin greater than the point spread.

Spread betting explained

For beginners, they may not quite understand what a negative means, and how to approach a bet when they see a number like this. The simple answer is that a negative point spread indicates the number of points, runs, or goals a team is favored to win by. For example, if a team starts as a On the other side, a positive point spread is for the underdog.

The point spread acts as a way to even out the two sides in a head-to-head bet as much as possible. One team might not have much of a chance to win outright, but keeping it close enough that the margin of victory is still under the negative point spread is a moral victory in the eyes of sportsbooks. In soccer, baseball, and hockey, they set the point spreads usually at Instead of adjusting the spread, they will adjust the payouts.

Betting on a team with a negative point spread means they are the favorites. If they still seem likely to win and cover, they can start to pay out pretty well. Some hate the idea of trusting the underdog team to stay competitive in a matchup. Every favorite needs to win by the amount they are favored by or more to cover the spread. With legalized sports gambling in certain states, people are less hesitant to discuss point spreads in non-gambling scenarios.

Take a team favored by 3. If they are going to win from a betting perspective, they need to win by four or more points. If the sportsbooks end up listing a team as a full number without the hook, there is always a chance of a push happening. Many people track whether or not teams can cover the point spread are not. Teams that are continually impressing by winning by more than they are supposed to can start to gain momentum in the betting world.

The sportsbooks are always trying to adjust accordingly, but they might not be able to keep up with a team on a hot streak. This leads to a several-game stretch of winning and covering. This is essentially the same thing as betting on the winner and loser, throwing the margin of victory out the window.

In this case, both teams are going to have a negative payout. Negative spread meaning The traditional way of sports betting with a point spread is to have both sides payout That extra money is referred to as the vigorish or juice in sports betting. This essentially ensures that a sportsbook is always making a profit.

Since the goal is to get the same amount of bets on either side, earning that little bit back will help them keep them in business. From a long-term winning perspective, the juice or vig is very important. The win percentage drops when placing bets on events that have multiple winner choices. Be on the lookout for sportsbooks that have their vig a little too high.

Sports are constantly changing. There are a few reasons why point spreads will change, even sometimes going from a negative point spread to a positive point spread in a matter of minutes. What are the main causes for a point spread change. Any of these can lead to things looking a little different in a hurry. That means that they likely did not do the best job of setting a proper point spread in the beginning.

Spreads can also refer to the difference in a trading position — the gap between a short position that is, selling in one futures contract or currency and a long position that is, buying in another. This is officially known as a spread trade.  In underwriting , the spread can mean the difference between the amount paid to the issuer of a security and the price paid by the investor for that security—that is, the cost an underwriter pays to buy an issue, compared to the price at which the underwriter sells it to the public.

In underwriting , the spread can mean the difference between the amount paid to the issuer of a security and the price paid by the investor for that security—that is, the cost an underwriter pays to buy an issue, compared to the price at which the underwriter sells it to the public.

In lending, the spread can also refer to the price a borrower pays above a benchmark yield to get a loan. The spread trade is also called the relative value trade. Spread trades are the act of purchasing one security and selling another related security as a unit. Usually, spread trades are done with options or futures contracts.

These trades are executed to produce an overall net trade with a positive value called the spread. Spreads are often priced as a single unit or as pairs on derivatives exchanges to ensure the simultaneous buying and selling of a security. Doing so eliminates execution risk wherein one part of the pair executes but another part fails.

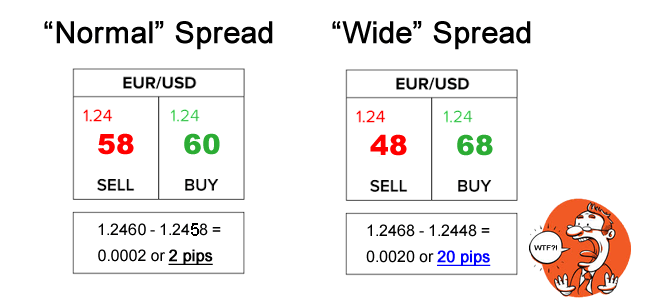

Spreads exist in many financial markets and vary depending on the type of security or financial instrument involved. In many securities that feature a two-sided market, such as most stocks, there is a bid-ask spread that appears as the difference between the highest bid price and the lowest offer. The bid-ask spread is often used to judge a stock's liquidity. Bid-ask spreads also feature prominently in forex trading, and can vary depending on a number of factors, including the liquidity of the currency pair, market conditions, and the broker's own pricing policies.

Some brokers charge fixed spreads, while others charge variable spreads that can fluctuate based on market conditions. It's important for traders to understand the spreads that they are being quoted, as they can have a significant impact on the overall cost of a trade. Spreads can be constructed in any number of ways, and so a trader can use a spread strategy to profit from a bullish, bearish, or sideways market, or if the spread widens vs.

Because of this, spreading is a very flexible tool used by traders. Treasury bond. If the investor believes that the risk of default on the corporate bond is low and the company is financially sound, they might decide to buy the corporate bond and sell the U. Treasury bond, in order to profit from the yield spread.

This would be known as a "yield spread trade. However, if the credit risk of Company XYZ turns out to be higher than expected and the bond defaults, the investor could lose their entire investment in the bond. This is why it is important for investors to carefully consider the credit risk of any bond before entering into a yield spread trade. An illustrative example of a spread used in trading is a bull call spread.

This is a bullish options trading strategy that involves the purchase of a call option with a strike price that is below the current market price, and the simultaneous sale of another call option with a higher strike price. The goal of this bull call spread is to profit from an upward move in the price of XYZ stock, while limiting the potential loss if the stock does not move as expected.

This is why the bull call spread is considered a limited risk strategy. Spread trading, like any other form of trading, carries a number of risks that traders and investors should be aware of. For example, market risk can affect the value of the underlying assets and the profitability of the spread trade.

Thus, if a trader enters into a bull call spread on a stock that they believe will rise in price, but the stock's price unexpectedly drops due to market conditions, the trader may suffer a loss on the spread trade. Likewise, if you bet that a spread will narrow but it widens, you can lose money.

In addition, there are other potential risks involved with spreads:. Most basically, a spread is calculated as the difference in two prices. A bid-ask spread is computed as the offer price less the bid price. An options spread is priced as the price of one option less the other, and so on. Traders look to profit from spreads by betting that the size of the spread will narrow or widen over time.

If you buy a spread, you believe that the spread between two prices will widen.