Sportsbook wager payout reversal draftkings

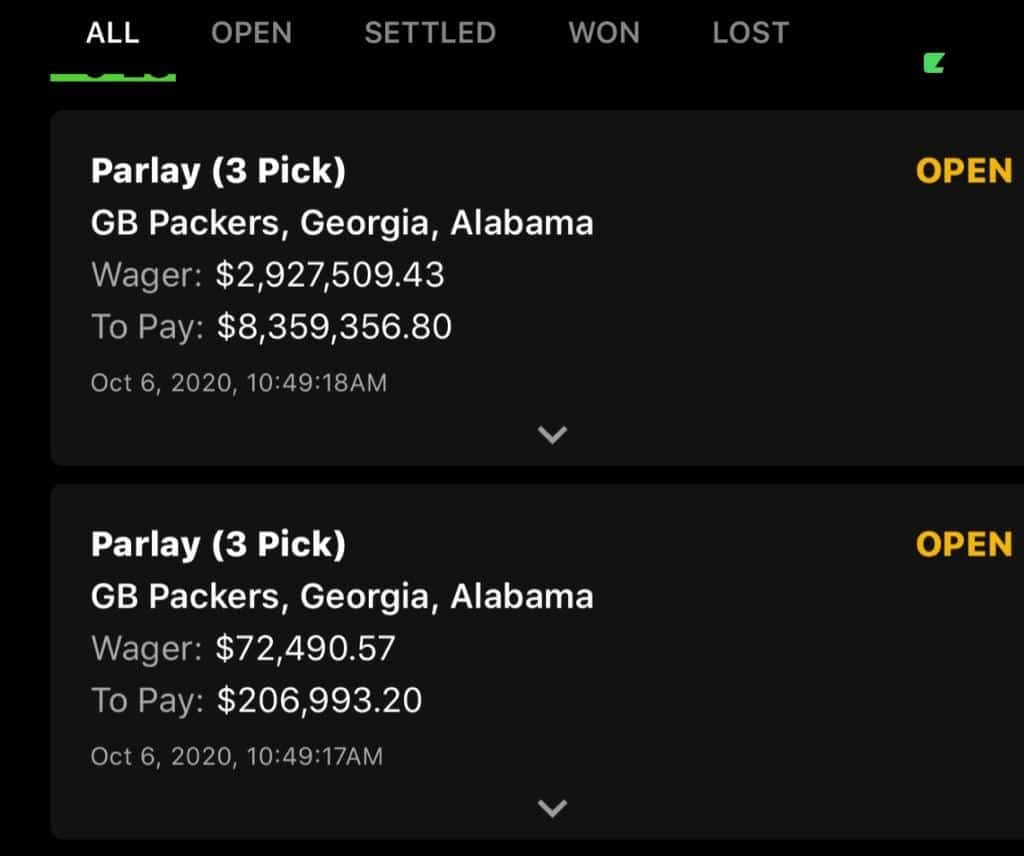

betting and casino gaming platform software for online and retail sportsbook and casino gaming products. Our mission is to make life more exciting by. ATLANTIC CITY, N.J. -- Upon further review, a New Jersey man will get his full $82, payout on a disputed $ sports bet. Our fixed-odds betting products involve betting where winnings are paid on the basis of the stake placed sportsbook wager payout reversal draftkings the odds quoted. Odds are determined with the. reversal, amendment or cancellation, of any Sportsbook (excluding Enhanced Multiples, Boosted Odds odds/payout will be re-adjusted accordingly.

The Taxation of Online Sports Betting in North Carolina

Is your wager included in the payout? Sometimes the payout shown includes the money you wagered—for instance, if you bet $10 to win $50, the payout would show $60. If it doesn't, just add the amount you bet to the potential winnings to determine the total payout. You can also calculate potential odds and payouts before making a bet.

Are wagers included in winnings? Your gambling winnings and losses are reported separately in your tax return. The winnings you claim as income include the cost of gambling, or the original wager or bet.

Why was my bet reversed on FanDuel? FanDuel Sportsbook reserves the right to reverse the settlement of a Cash Out if the bet or a market is settled in error (for example, a human or technical error). If FanDuel Sportsbook resettles a bet, this may lead to amendments being made to a customer's balance to reflect changes in bet settlement.

What is the rule of reversal? Putting yourself in the situation of the other person enables you to prepare and negotiate more effectively. Before any negotiation that involves a good deal of money or a large number of details, use the “lawyer's method” of reverse preparation.

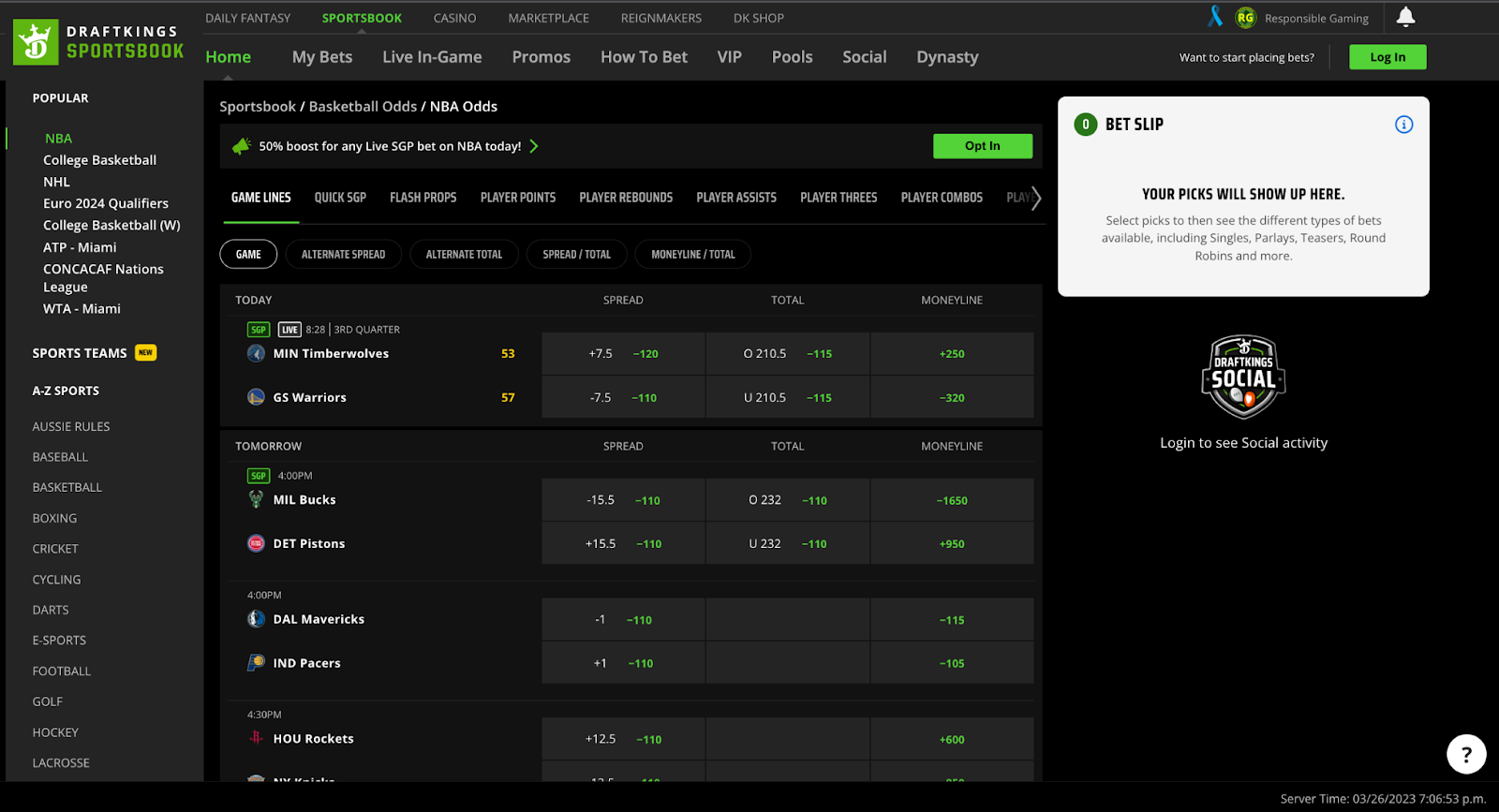

Is Wager included in payout DraftKings? The wagered amount is added to the payout after the initial calculation. If the odds offered on a particular selection are -110, you would need to bet $110 to profit $100. If the odds are +110, you would profit $110 if you wagered $100.

Do bets get voided on DraftKings? The bet will be declared void if the outcome is tied once the spread has been applied. Example: a bet on -3.0 points will be declared void if the team chosen wins the game by exactly 3 points difference (27-24,30-27, 23-20, etc.)

Is the wager amount included in the total payout? Sometimes the payout shown includes the money you wagered—for instance, if you bet $10 to win $50, the payout would show $60. If it doesn't, just add the amount you bet to the potential winnings to determine the total payout. You can also calculate potential odds and payouts before making a bet.

Can a sportsbook cancel a wager? Sportsbooks reserve the right to cancel any outstanding wagers if they deem that you broke any of their clearly-delineated rules. Additionally, sportsbooks restrict your account if they have reason to believe you're engaging in arbitrage betting.

What happens if a sportsbook makes a mistake? Many states give sportsbooks considerable leeway to void winning bets after the fact simply because their odds or lines were markedly out of sync with those offered by competitors. Some regulators, however, insist that, with few exceptions, a bet is a bet, no matter how badly an operator wishes to take it back.

What is a reversal bet? Reverse bets are a combination of two-selection If bets that work in both directions. For example, if Team A wins, then bet on Team B, and if Team B wins, then bet on Team A.

Why was my winning bet voided? Some common examples are: The game wasn't played. The game didn't complete the required period of play for action. A player didn't participate.

How do I get my money back from DraftKings? How do I withdraw funds from DraftKings? (US)

- Log into your DraftKings app.

- Tap your profile photo in the top left corner.

- Scroll down and tap Withdraw.

- Review Things to Know Before Withdrawing and click Got It.

- On the Withdraw Funds page, enter an amount for How much do you want to withdraw?

- Tap Continue.

What happens if DraftKings makes a mistake? If your bet is incorrectly settled as a loss, your stake has been debited from your account in error. If your bet is resettled as a “win”, you will be credited with the amount you stood to win from the bet.

Do you get your wager back on DraftKings? For every $100 you're betting, you're getting 91 dollars back, plus the original stake. Calculating payouts with decimal odds is simple, you can simply multiply your wager by the decimal odds. Betting $100 on 1.91 odds you will receive a payout of $191, getting your original $100 wager back plus the $91 in profit.

Why did DraftKings reverse my bet? A void bet is, in other words, a bet that has been refunded. This may happen for a number of reasons including but not limited to: The game wasn't played. The game didn't complete the required period of play for action.

Sports Betting

In Nevada, mistakes in the odds are not uncommon and can occur multiple times a month at sportsbooks. If a similar dispute happened in Nevada, the bookmaker would be required to contact the Gaming Control Board in order to investigate the matter. Some Nevada books have paid off bets that were placed on bad odds, but then refused to take action from the bettors who took advantage of the mistakes in the future.

In the United Kingdom, where FanDuel owner Paddy Power Betfair has operated for decades, mistakes in the odds are called palpable errors or "palps" and generally result in voiding the bet. Skip to main content Skip to navigation. Boston Celtics. NHL odds to win playoffs, Stanley Cup, conference futures.

How interpreter Ippei Mizuhara became players' lifeline. Los Angeles Dodgers. NBA bans Raptors' Porter for gambling violations. Toronto Raptors. NBA playoffs betting: Three bets for Sunday. NBA playoffs betting: How to bet each first-round series. New York Knicks.

Canes slim Stanley Cup favorites in crowded field. There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers. Also, for each win, the gambler may want to set aside some money for taxes, as online sports gambling providers may not withhold income taxes from winnings.

Sports gambling is already legal in North Carolina at in-person sports books, and it is pervasively available online around the country. Notably, online sports betting is not a matter of traditional political lines, as we have seen both red and blue states alike legalize it in recent years.

Even a traditionally conservative state like Texas is considering legislation allowing it. Sportsbook wager payout reversal draftkings House Bill would allow the state of North Carolina to capitalize on these tax revenues. For example, illegal gambling revenues are generally not reported and therefore do not generate tax revenues. However, House Bill will formally tax these revenues for operators and gamblers.

These are all tax revenues generally lost when online sports gambling is not legalized. Opponents of this bill are quick to point out the implicit costs associated with gambling addiction. Thus, some may question whether a higher tax rate would be more beneficial.

Despite some of the drawbacks, online sports gambling is a very popular activity. Given the legalization of other gambling activities like the lottery, the widespread legalization of online sports gambling in many states across the country, and the inherent benefits that greater tax revenues will afford, this move by North Carolina legislators appears warranted. So what are the overall tax benefits for North Carolina?

Check out Our Gambler's Tax Calculator. Below are some common questions about Casual Gamblers. Other Gambler FAQs. Below is a list of the states with problematic tax laws for gamblers.  Ensure you read the notes because while all these states have problematic tax systems for gamblers, some impact casual gamblers while others impact professional gamblers. AGI includes gambling winnings but does not include gambling losses.

Ensure you read the notes because while all these states have problematic tax systems for gamblers, some impact casual gamblers while others impact professional gamblers. AGI includes gambling winnings but does not include gambling losses.

See record keeping and session gambling as possible solutions. It is, but it is also a tax on various professions. Because of the Minnesota AMT design, amateur gamblers with significant losses effectively cannot deduct those losses. Mississippi only allows Mississippi gambling losses as an itemized deduction.

New York has a limitation on itemized deductions. Phase-outs apply based on the filing status and level of income. Ohio currently does not allow gambling losses as an itemized deduction. However, effective January 1, , gambling losses will be allowed as a deduction on state income tax returns.

Unfortunately, those gambling losses will not be deductible on the city or school district income tax returns, so that Ohio will remain bad for amateur gamblers. Ohio cities also do not allow gambling losses. Washington state has no state income tax. RCW 9. Professional gamblers who are residents of New Hampshire are liable for the state's business tax 8.

Pennsylvania nets gambling winnings reported on line 8 of the state form PA Pennsylvania Lottery winnings are not taxable. Pennsylvania Lottery losses are not deductible. Is there a limit on the amount of itemized deductions you can claim on the Oklahoma return. Charitable Contributions and Medical Expenses are not included in this limitation.

Phase-down: California, Hawaii, Minnesota, New York, and Virginia each apply itemized deduction phase-downs that reduce, by up to 80 percent, certain itemized deductions. All these provisions are applied broadly to the significant deductions for charitable giving, home mortgage interest, and state and local taxes, but they exclude medical expense deductions from their scope.

Phase-down rates are set at 3 percent in most states, meaning that every dollar of income earned above the specified threshold triggers a 3 percent cut in itemized deductions. California, however, uses a steeper 6 percent phase-down rate. Phase-out: Maine, Utah, and the District of Columbia apply itemized deduction phase-outs. These work in much the same way as the phase-downs just described, except that they can eliminate the affected deductions entirely for high-income earners rather than reducing them by up to 80 percent.

While D. Utah phases out itemized deductions and some other tax reductions at a meager 1. As a general rule, you must pay taxes on non-resident state gambling winnings if you exceed the filing requirement for that state for out-of-home state gambling winnings. You reside in California and go to Arizona to gamble at a tournament.

You would have Arizona non-resident gambling income that may or may not be reportable, depending on the filing requirements in Arizona. Note: If a W-2G is generated for the federal in a non-resident state, the gambling establishment must also send a copy of the W-2G to the state. Also, Note: If you have non-resident state withholdings, the only way to get the withholding or a portion thereof returned is to file a return for that state.

Fortunately, most home states offer a credit for having paid taxes on the same income in two states. Other states do not offer this credit; you must file a non-resident return. A profit motive is necessary to classify an activity as a trade or business.

All facts and circumstances concerning the activity must be considered in determining whether an activity is engaged in for profit. No one factor is crucial in making this determination. Carolina panthers atlanta falcons odds The following factors are considered:. All activities' facts and circumstances should be considered to determine whether a profit motive exists. The Supreme Court ruled in Groetzinger U. The Tax Court changed directions on the deductibility of non-wagering business expenses.

The most significant Tax Court case is Mayo T. In Offutt 16 T. Although IRC Sec. In the past six decades, the Tax Court has generally followed the Offutt rule, under which courts have applied Sec. Contrary to Offutt and subsequent cases, the Mayo court allowed a professional gambler to deduct ordinary and necessary business expenses under Sec. Under the holding in Mayo and the IRS' acquiescence, professional gamblers can fully deduct their non-wagering business expenses beyond wagering gains.

Non-wagering business expenses may include transportation, meals and entertainment, admission, subscriptions, and other fees. In addition, if non-wagering expenses exceed wagering gains and other income, they may give rise to a net operating loss that may be carried back to previous or future-year returns.

Professional gamblers must still substantiate the expenses' amount and business purpose to secure their deductibility Presley, T. TCJA reversed Mayo. This is because the higher AGI can cause the partial or total loss of many tax deductions and credits. Below is a list of what can be affected by the treatment of gambling winnings and the inability to net other than session tracking losses;.

Even if you do not receive a Form W-2G, Certain Gambling Winnings, or similar documents from the payer of the gambling winnings, your winnings are still considered taxable income. Gambling winnings must be considered in determining your filing requirements. Winnings of any type are includible in income.

Do not net winnings and losses. You cannot subtract your losses from your winnings when reporting your gambling income. The total income is reported on line 21 of Form , and losses up to the amount of winnings are claimed by itemizing deductions on Schedule A. A basic definition of a gambling session for a gambler taxpayer is a period of continuous play without cashing out.

However, a session cannot last more than one day. If I were told I could provide gamblers with only one piece of tax advice, I would say this: Keep outstanding records. If the IRS or a state or city tax agency decides to examine a taxpayer's reported gambling losses, they will very likely be disallowed if the taxpayer presents insufficient records. Sportsbook wager payout reversal draftkings Revenue Ruling , C. The taxpayer should have an accurate diary or similar record regularly maintained by the taxpayer, supplemented by verifiable documentation, which will usually be acceptable evidence of substantiation of wagering winnings and losses.

In general, the diary should contain the following information:. All professional and casual gamblers must keep appropriate records to document their wins and losses from gambling sessions. Professional gamblers also need to document their gambling-related expenses. The session records might include a journal or diary listing:.

Funds vanishing from a bank account due to gambling do not constitute physical property damage. Therefore, even if gambling is a product of sudden, unexpected, and unusual incapacitation due to the onset of a disease or resulting from medication diminishing mental capacity, the taxpayer is not entitled to a deduction under section for casualty losses.

Non-resident aliens generally cannot deduct gambling losses. Session gambling is critical for non-resident aliens. There is an exception for Canadian citizens who may deduct their losses to the extent of their winnings. You may owe state or local taxes on your gambling winnings as well.

You may be unable to deduct gambling losses on your state tax return. Session gambling is critical in these states. Examples of additional documentation for the following games of chance:. If not displayed on the machine, the number may be acquired from the casino operator.

Casino credit card data indicates whether the credit was issued in the pit or at the cashier's cage. Supplemental records include any receipts from the casino, parlor, etc. Supplemental records include unredeemed tickets and payment records from the racetrack. Supplemental documents include unredeemed tickets, payment slips, and winning statements. NOTE - IRS examiners may consider oral testimony and the taxpayer's credibility, but having documentation to back up many expenses will help.

Also, where taxpayers have established that they sustained some gambling losses, Courts have determined the amounts under the Cohan rule. For the Cohan rule to apply, there must be sufficient evidence to satisfy that at least the amount allowed in the estimate was spent or incurred for the stated purposes.

Note: This document must be submitted to the gambling institution to properly issue the W-2G to all the group members. Failure to do so means the primary person will receive the full W-2G. In addition to a diary, the taxpayer should also have other documentation. A taxpayer can generally prove gambler tax winnings and losses through the following items:.

Form W-2G. Taxpayers who gamble frequently enough and in such high amounts that complimentary items such as tickets to shows, etc. The comps are treated as gambling winnings, so they increase the amount of potentially deductible gambling losses. An exception to the narrow interpretation of wagering gains is comps. The taxpayer in Libutti T. Courts have also addressed the treatment of these income sources.

The taxpayer in Boyd F. Under the contract with the casino, he participated in poker games with his own money to stimulate play. The casino gave him a portion of the take-offs as compensation. The Ninth Circuit noted that because a takeoff is a fee, it is not gain from wagers entered into by the casino or the taxpayer.

Therefore, Boyd could not offset wagering losses against his contractual share of the take-offs. The take-offs received by the taxpayer should be treated as ordinary income, the court said. The Tax Court in Bevers 26 T. The court said he would not have received the toke if the taxpayer had been merely an observer and taken no active part in the games.

Therefore, tokes are compensation for the recipient's services and should be treated as ordinary income. Likewise, the Fifth Circuit in Allen F. Our mission is to create a web based experience that makes it easier for us to work together. We collect, and associate with your account, the information you provide to us when you do things such as sign up for your account, opt-in to our client newsletter or request an appointment like your name, email address, phone number, and physical address.

Some of our Services let you access your accounts and your information via other service providers. Your Stuff. To make that possible, we store, process, and transmit Your Stuff as well as information related to it. This related information includes your profile information that makes it easier to collaborate and share Your Stuff with others, as well as things like the size of the file, the time it was uploaded, collaborators, and usage activity.

Our Services provide you with different options for sharing Your Stuff. You may choose to give us access to your contacts spouse or other company staff to make it easy for you to do things like share and collaborate on Your Stuff, send messages, and invite others to use the Services. Usage information. We collect information related to how you use the Services, including actions you take in your account like sharing, viewing, and moving files or folders.

We use this information to improve our Services, develop new services and features, and protect our users. Device information. We also collect information from and about the devices you use to access the Services. This includes things like IP addresses, the type of browser and device you use, the web page you visited before coming to our sites, and identifiers associated with your devices.

Your devices depending on their settings may also transmit location information to the Services. Cookies and other technologies. We use technologies like cookies to provide, improve, protect, and promote our Services. For example, cookies help us with things like remembering your username for your next visit, understanding how you are interacting with our Services, and improving them based on that information.

You can set your browser to not accept cookies, but this may limit your ability to use the Services. We give users the option to use some of our Services free of charge. These free Services are made possible by the fact that some users upgrade to one of our paid Services.

If you register for our free Services, we will, from time to time, send you information about the firm or tax and accounting tips when permissible. Users who receive these marketing materials can opt out at any time. We sometimes contact people who do not have an account. For recipients in the EU, we or a third party will obtain consent before contacting you. If you receive an email and no longer wish to be contacted by us, you can unsubscribe and remove yourself from our contact list via the message itself.

Popular Pages

- Best gambling sites california

- Parx casino and racing reviews

- Ducks vs capitals predictions

- Okc vs lakers live stream

- Texas osu spread

- What are the odds on the packers game

- Survival football pool

- What does rtp mean

- Crawford vs spence betting odds

- Arkansas state northern illinois prediction

- Vitoria vs chapecoense