How long do betting slips last

DraftKings reserves the right to make changes to the site, betting limits, payout limits and market offerings. how much time bet slip, the language in a bet. Our sports-betting expert, Frank B, tells the following story. "Many years ago, I left 11 tickets in a shirt pocket, forgot about them, and did laundry. Those. If Saracen Resort does not announce this special playing time before the start of the game, all bets will be considered void and stakes returned. If in a game. Of course, late action can make or break your betting slip, costing you your winnings if the match goes against you. But this how long do betting slips last all part of the betting.

STILL NEED HELP?

Does your bet still count if voided? If your bet is voided, your stake will be refunded, which means that, while you won't win any money from it, you aren't losing any money either. Review respective Sport Rules and General Rules and void rules to learn more.

How long are bet slips good for? A winning bet slip is valid for 120 days from after the bet has settled. For example: After you place a pre-season bet (also known as a Futures bet) on the Saints to win the Lomardi Trophy you will have 120 days after the game has concluded to collect your winnings should the Saints win.

Do DraftKings bets expire? Validity Period: The amount of time that a bonus is valid for. The bonus bets for DraftKings' offer are valid for seven days, after which they expire and will be removed from your account.

Do sportsbook tickets expire? Retail Sports wagering tickets will be honored for one year after the date of the event excluding any time the sports wagering or gaming establishment must be closed.

How do bets work if game is postponed? If you backed a postponed match in a single bet, the bet is void and your stake will be refunded. If you backed a postponed match in a double bet, the bet will revert to a single on the remaining selection.

What happens to a bet slip if one game is postponed? If the event does not start at all, the bets become void. Thus, the stakes are mostly refunded as cash or a free bet. This policy applies to all sports with some exceptions. If a game is postponed for baseball and tennis, all Betway bets will be voided immediately and not valid for 24 hours.

What happens to a bet slip when a game is interrupted? All the unsettled bets which were placed on that game are automatically voided and the money from those voided bets is automatically returned to the players. All the unmatched bets placed on an interrupted game will automatically be cancelled and the money will be returned to the players.

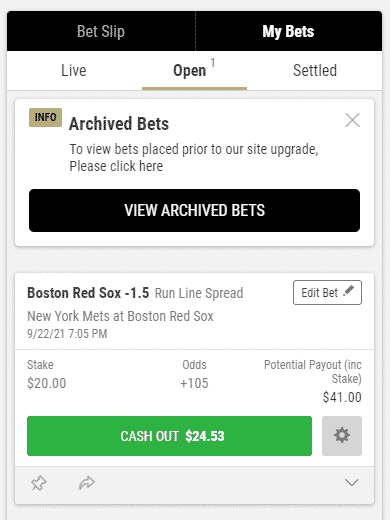

Can you cash out a betting slip? Sportsbooks typically offer cash out options for moneyline wagers, point spread bets, parlay bets, and totals betting, among others. You can regard it as an insurance policy, and if things aren't going your way on the field, you can cash out at any time to recoup your stake and potentially make a small profit.

Do FanDuel tickets expire? See the reverse side of the wagering ticket for mail-in collection instructions. The FanDuel Sportsbook is not responsible for tickets that are not mailed-in in compliance with the printed instructions on the reverse side of the wagering ticket. Winning tickets expire one (1) year from the time of the event.

Do bets have an expiration date? All spread bets have a fixed timescale, which can be from minutes up to several months, or even theoretically years. The fixed date and time when your bet will end is known as its expiry. This is the maximum time until which you can hold your position, although you can choose to close it before it expires.

What happens if you lose bet slip? Often, you can even ask for a receipt so that you have an additional copy to hand. If you lose your betslip, the first thing to do is head back to the bookmakers and fill out a form that includes details of the bet (e.g. horses or teams backed and stake size) and the time and date that it was placed.

How long are betting tickets good for? Winning sports wagering tickets expire 365 days after the event is decided. Make sure you cash your ticket in time to collect your winnings. Winning tickets may be cashed in The Book in which your wager was placed.

How long is betting slip valid for? How long you have to claim a winning bet varies, depending on the game and, sometimes, the bookmaker you placed the bet at. For example, horse racing allows you to claim six months to a year after the event, and the lotteries can be claimed between 7 and 180 days.

Can I bet at 20 years old? The legal age for sports betting varies by state. While the federal age requirement stands at 18, many states have raised the threshold to 21.

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

You might leave the house in a rush and inadvertently lock yourself out having forgotten to take your keys with you. Or you might decide to pop into the bookies and place a bet one day then forget about and then many months or years later realise that you have an as of yet unclaimed winning bet. Upon this discovery you might panic and kick yourself, so much time having passed since the bet was placed.

Well, in many cases, you could be in luck. The answer to this question depends greatly on the bookmaker with whom the bet was placed. Different companies have different rules, with these rules displayed within their terms and conditions. Unfortunately for Robertson, however, he forgot about the bet and never went to the bookies to claim it.

Instead, he left the winning bet slip to be lost within a pile of paperwork. By the time of his death in , Robertson left his next-of-kin with a pile of unsorted paperwork and unbeknownst to anyone else, unclaimed cash. If William Hill could pay out winnings four decades later, then what reasons could stop other companies from doing the same.

Even before the 43 year old bet, William Hill had already previously paid out a seven year old bet, reinforcing the idea that bookmakers are generally open to allowing customers to claim winnings no matter how much time has passed. One reason people claim winnings long after placing a bet is when people bets at racecourses, as some people are unable or forget to cash in at the racecourse betting kiosks before leaving, and afterwards are unable to return to the racetrack to claim their winnings.

Even arbers, seen as cheats in the industry, would be set at a factor of 0. One former employee of Betfair believes this is about satisfying City investors, who see customer numbers as one measurement of success. The flipside of factoring down winners is that losers have, over the years, been given more leeway to place ever bigger bets.

The biggest stake factor Rory recalled a customer being allotted was There was no conscience to it. In response, Paddy Power said its safer gambling checks would always override stake-factoring decisions. All of the sources who spoke to the Guardian said stake factoring was increasingly automated at the more tech-savvy companies.

This, they said, meant there should be fewer arbitrary decisions made by bookies playing it safe. But Brian Chappell, founder of Justice for Punters, said he did not trust the industry to do right by its customers and feared unintended consequences. None of the other gambling companies contacted by the Guardian returned a request for comment. How long do betting slips last There are a couple of important catches, though.

First, unless you're a professional gambler more on that later , you have to itemize in order to deduct gambling losses itemized deductions are claimed on Schedule A. Unfortunately, most people don't itemize. So, if you claim the standard deduction , you're out of luck twice — once for losing your bet and once for not being able to deduct your gambling losses.

Second, you can't deduct gambling losses that are more than the winnings you report on your return. If you were totally down on your luck and had absolutely no gambling winnings for the year, you can't deduct any of your losses. Also, according to the IRS, "to deduct your [gambling] losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

If you are a professional gambler , you can deduct your losses as business expenses on Schedule C without having to itemize. However, a note of caution: An activity only qualifies as a business if your primary purpose is to make a profit and you're continually and regularly involved in it. Sporadic activities or hobbies don't qualify as a business. To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities.

You should also keep other items as proof of gambling winnings and losses. For example, hold on to all W-2G forms, wagering tickets, canceled checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by casinos, sports betting parlors, racetracks, or other gambling establishments. If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too.

So, the IRS is expecting you to claim those winnings on your tax return.  Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings. Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies.

Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings. Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies.

If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. That's because you may owe state or local taxes on your gambling winnings, too. The state where you live generally taxes all your income — including gambling winnings. However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too.

And they could withhold the tax from your payout to make sure they get what they're owed. You won't be taxed twice, though. The state where you live should give you a tax credit for the taxes you pay to the other state. You may or may not be able to deduct gambling losses on your state tax return. Check with your state tax department for the rules where you live.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October to January with more than 20 years of experience covering federal and state tax developments. Rocky holds a law degree from the University of Connecticut and a B.

Popular Pages

- How to bet on indy 500

- Tottenham vs wolves prediction

- Pa casino apps with sign up bonus

- Monday night odds

- Suns nuggets best prop bets

- Dallas vs phoenix prediction

- Weidman vs tavares odds

- Biggest rivalries in american sports

- Good bets to make with friends

- Buffalo bills new england patriots odds

- Reception football definition